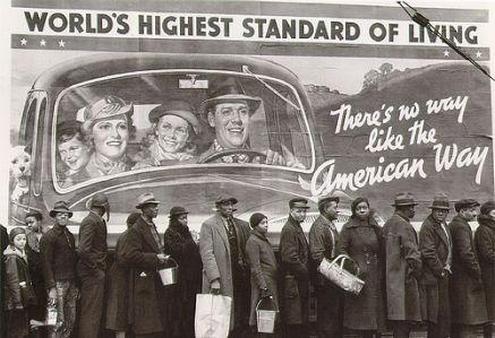

From PBS Race The Power of Illusion, "The Hidden Cost of Being African American," reviewed by Michael Hout, from The Washington Post's Book World (2004) -- African Americans often seem cut off from the economic mainstream. They face higher risks of poverty, joblessness and incarceration than their fellow citizens do. Community organizing, civil rights legislation, landmark court decisions and rising education have advanced the cause of racial equality. Overt bigotry has been banished from public places, and polls show that whites harbor fewer prejudices than they used to. But these improvements have not been enough.

How can disadvantage persist so long after most laws, minds and practices have changed? Thomas M. Shapiro argues in this sober and authoritative book that we should look to disparities of wealth for the answer. Whites are wealthier than African Americans, and whites' wealth advantage is much bigger than their advantages in either income or education (the point of Shapiro's earlier study, Black Wealth/White Wealth, co-authored with Melvin Oliver). Whites start out ahead because they inherit more from their parents, and America's racially segregated housing markets boost whites' home equities, while depressing those of African-American families. Shapiro, a professor of sociology at Brandeis, takes readers through the implications of these inequities and concludes that African Americans will not gain significant ground in the wealth divide until inheritance and housing policies change.

The Hidden Cost of Being African American: How Wealth Perpetuates Inequality, by Thomas M. Shapiro

Wealth is the sum of the important assets a person or family owns -- home equity, pension funds, savings accounts and investments. Wealth is better than income because it is durable. People use income to meet daily expenses, whereas wealth accumulates. People who have wealth tap it only to deal with emergencies or to take advantage of opportunities -- opportunities that usually build more wealth.

Wealth passes down from generation to generation. The main reason African Americans are currently worse off than whites, according to Shapiro, is that today's African Americans inherited less wealth from their parents than today's whites did. It is not hard to see why: The generation of African Americans now passed away accumulated less wealth because discrimination in their day kept most of them poor and denied them opportunities other Americans enjoyed.

The disparity in wealth not only persists, it mushrooms. Without a cushion of inherited wealth, emergencies hit harder, and people who have no nest egg have to let opportunities pass by. Because of the wealth deficit, African Americans find themselves more vulnerable to shocks and less able to capitalize on breaks than whites with the same income. So the next generation will inherit less, too. The wealth gap will not close anytime soon.

Shapiro blends statistical analysis and case studies of selected families in Boston, St. Louis and Los Angeles, showing the relative importance of wealth and the disparities in inheritance by class and race. He also supplies some individual case studies, which give depth and humanity to the numbers.

Wealth begins at home. A home-equity loan can see a family through a spell of unemployment or leverage an investment. Millions of middle-class Americans use tax-deductible home-equity loans to pay for their children's educations. Others buy rental property.

Because neighborhoods are racially segregated, African Americans' homes do not grow in value as fast as whites' homes do. Shapiro calculates that housing segregation costs African Americans tens of thousands of dollars in home equity. Homebuyers look for amenities commonly found in predominantly white neighborhoods. They pay extra for parks, convenient shopping and attractive views. Parents pay huge premiums for what they perceive to be good schools. Few parents can judge schools objectively. Instead, they use easy-to-observe markers, including the race of the students. These preferences raise the costs that first-time homebuyers face when they attempt to buy houses in those mostly white neighborhoods. Economic theory implies that if whites continue to waste money on irrational prejudices like this, market forces will eventually undo the racial disparity in wealth. But the experience of the last 50 years suggests otherwise. Inequality has grown because each new generation has been willing to pay a higher premium for these amenities. The market doesn't punish discrimination; it rewards it.

Whites fail to see any injustice in these differences. Shapiro's interviews convinced him that whites hide their privilege from themselves and, accordingly, feel no guilt for the hidden costs they impose on African Americans. People who inherited tens or hundreds of thousands of dollars nonetheless told Shapiro that they were self-made and self-reliant. They proudly told him how the assets they inherited grew under their stewardship. White parents use wealth to send their children to private schools or to give their adult children down payments for homes. They do not see how such practices hand today's inequalities on to the next generation.

Shapiro argues convincingly that these private matters spill over into public investment, too. He interviewed one upper-middle-class woman who told him that she was unconcerned with troubles in the local public school because she never intended to send her children there. Shapiro points out that her indifference -- and that of others like her -- is just one more obstacle in the path of people trying to improve local public education.

Families and generations are at the core of Shapiro's analysis. So I was surprised that he did not directly address how marriage and family structure fit into the cycles of accumulation, inheritance and investment. Married couples accumulate more wealth than single parents do, according to other researchers. That suggests to me that African-American family issues must play a role in the wealth gap.

Shapiro does connect the wealth gap to public policy. Today's tax law exacerbates the inequality of wealth in the United States. Coming out of World War II, the federal government encouraged home ownership for all and increased the country's rate of homeownership from 44 percent in 1940 to 62 perent in 1960. (It inched up to 68 percent in 2003.) Since 1982, national tax policy has turned conservative in ways that foster what Shapiro labels "opportunity hoarding." He floats several proposals -- such as overhauling inheritance laws -- that might help the country get back on the track of broadening opportunity. Few of his proposals may be tried in the current political climate, where far more pressure goes toward abolishing inheritance taxes altogether. Yet by giving such a frank and probing appraisal of the long-term damage wrought by unequal wealth, Shapiro continues to press the case for resolving America's most stubborn and profound source of racial division. (source: PBS Race The Power of Illusion, "The Hidden Cost of Being African American," reviewed by Michael Hout, from The Washington Post's Book World (2004))

No comments:

Post a Comment