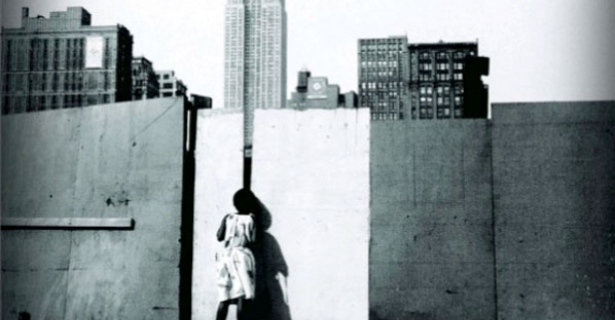

As reported in the January/ February 2013 edition of the Washington Monthly Magazine, "A House Divided: Why do middle-class blacks have far less wealth than whites at the same income level? The answer is in real estate and history, by Thomas J. Sugrue -- In 1973, my parents sold their modest house on Detroit’s West Side to Roosevelt Smith, a Vietnam War veteran and an assembly-line worker at Ford, and his wife, Virginia (not their real names). For the Smiths—African Americans and native Mississippians—the neighborhood was an appealing place to raise their two young children, and the price was within their means: $17,500. The neighborhood’s three-bedroom colonials and Tudors, mostly built between the mid-1920s and the late ’40s, were well maintained, the streets quiet and lined with stately trees. Nearby was a movie theater, a good grocery store, a local department store, and a decent shopping district. Like many first-time home buyers, the Smiths had every reason to expect that their house would be an appreciating investment.

For their part, my parents moved to a rapidly growing suburb that would soon be incorporated as Farmington Hills. Their new house, on a quiet, curvilinear street, was a significant step up from the Detroit place. It had four bedrooms, a two-car attached garage, and a large yard. It cost them $43,000. Within a few years, they had added a family room and expanded the small rear patio. Their subdivision, like most in Farmington Hills, was carefully zoned. The public schools were modern and well funded, with substantial revenues from the town’s mostly middle- and upper-middle-class taxpayers. All of the creature comforts of the good suburban life were close at hand: shopping malls, swim clubs, movie theaters, good restaurants.

My parents lived in the Farmington house for a little over twenty years. When my father retired in the mid-1990s, the property had appreciated by about $100,000. They did not get rich from the proceeds of their home sale—indeed, after adjusting for inflation, the house was worth slightly less than they paid for it, not even counting interest costs and taxes. But it nonetheless allowed them to walk away with about $80,000.

For the Smiths it was a far different story. Detroit had been losing population since the 1950s, and especially after the 1967 riots there was massive “white flight” from the city. The neighborhood in which the Smiths invested went from mostly white to black within a few years, along with the rest of Detroit. For the city as a whole, those who remained were not as well off on average as those who left, meaning that even as the tax base shrank, the demand for city services went up, setting off a vicious death spiral. Soon, schools and infrastructure groaned with age, and the city’s tax base shrank further as businesses relocated to suburban office parks and shopping centers. By the end of the ’70s, the decline of the auto industry and manufacturing generally compounded Detroit’s woes, as production shifted to Japan or the South in search of cheaper labor and fewer regulations.

As the downward cycle continued, investors and absentee landlords—fearful that their property values would decline as Detroit got poorer and blacker—let their properties run down. Rising crime led to a drop in pedestrian traffic both downtown and in neighborhood shopping districts, and also to increasing demand for additional police protection. As the cost of city services surged and the tax base shrank, Detroit came to have among the highest property tax rates in the nation, which was another reason for people to move out if they could.

Meanwhile, places like Farmington Hills, which were all white in the ’70s and ’80s, were direct beneficiaries of Detroit’s decline. The seemingly insatiable demand for suburban real estate raised housing values; well-funded schools attracted families with children; local malls had few, if any, vacancies; and new shops and office parks seemed to spring up daily.

The same year that my father retired, I visited my childhood neighborhood, and drove past the Smiths’ house. The lawn was lush, the shrubs well tended. They had built a garage. The old siding had been replaced and the original windows updated. I stopped at a local real estate broker’s office to check out the housing prices in the area. The Smiths’ home was not for sale, but another house just two blocks away, almost identical to it and in move-in condition, was on the market for $24,500. Over two decades, Roosevelt and Virginia Smith’s house in my parents’ old neighborhood, despite love and care and investments, had appreciated by only about $7,000. After adjusting for inflation, their house was worth about 60 percent less than they had paid for it.

In the United States, where real estate is the single largest source of asset accumulation for the middle class, the story of the Sugrues and the Smiths goes a long way to explaining the expanding disparities between white and black wealth. The two families—like many Americans—invested in real estate both for its use value and as a gamble on the future. But one family did far, far better than the other.

Every once in a while, a scholarly book fundamentally shifts how we understand a problem. One of those books was published in 1995, two years after my parents sold their house. Sociologists Melvin Oliver and Thomas Shapiro’s Black Wealth/White Wealth stepped into a stale debate about race, class, and inequality in the United States with new data and a fresh perspective. The authors acknowledged the gains of the civil rights era: Black-white income gaps had narrowed. Minorities were better represented at elite institutions of higher education than could have been imagined in 1960. And while in the ’60s the most prominent black elites were car dealers or owners of “race businesses” that catered to black customers, by the end of the twentieth century the number of black engineers, lawyers, and corporate executives had grown. Newsmagazines trumpeted the high incomes of black sports stars and celebrities. “The New Black Middle Class” became a tagline. African Americans might not have wholly overcome the legacy of centuries of slavery and segregation, but they had come a long way.

But Oliver and Shapiro told another story, a sobering one about the persistent gap between black and white wealth. They methodically gathered and analyzed data about household assets, like real estate holdings, bank accounts, stocks and bonds, cars, and other property, that constitute a family’s portfolio. Their findings were staggering: despite all of the gains of the previous quarter century, the median black family had only 8 percent of the household wealth of the median white family. The asset gap was still strikingly wide among middle-class and wealthy blacks, who, despite their high incomes, still had about a third the assets of comparable whites.

The racial wealth gap has several specific causes beyond the broad legacy of systematic racial segregation, discrimination, and unequal opportunity. Wealth is passed down from generation to generation—even if only modestly. But going back generations, blacks had little opportunity to get a stake hold. Upon emancipation, they were mostly penniless, without land or access to credit (see Reid Cramer, “The American Dream, Redeemed,” page 45), and almost all blacks were excluded from the various Homestead Acts that, beginning in 1862, allowed so many poor white families to accumulate land and, with it, wealth.

Meanwhile, most African Americans earned too little to save; most lacked access to the loans and capital necessary to start a business or buy stock or own their own homes. Lack of financial assets made African Americans more vulnerable to unemployment and medical emergencies, less likely to be able to pay for their children’s college education, and more likely to be stuck with the burden of supporting impoverished parents or to face poverty themselves in old age.

Even with the coming of Social Security and stronger protections for organized labor under the New Deal, most blacks were excluded from the benefits because they worked as tenant farmers or domestics who were not covered by the new plans. Two other Depression-era federal programs—the Home Owners’ Loan Corporation and the Federal Housing Administration—encouraged homeownership and bankrolled suburbanization, but in the North and South alike, whole neighborhoods were redlined, many of them black.

Many African Americans lost out on the benefits of the post-World War II GI Bill as well. As Ira Katznelson points out in his book When Affirmative Action Was White, of the 3,229 home, business, and farm loans made under the GI Bill in Mississippi during 1947, black veterans received only two. Until 1968, it was virtually impossible for blacks to get access to the kinds of long-term, low-interest mortgages that made wide-scale homeownership possible.

Even after the passage of civil rights laws, dozens of studies showed that minorities had a harder time getting access to market-rate mortgages. Moreover, black home buyers were likely to be steered to neighborhoods of older housing stock, often in declining central cities, places where housing values often depreciated rather than appreciated. This meant that blacks, if they were lucky enough to be homeowners, were often trapped in neighborhoods on the margins, economically and politically. As it turns out, the Sugrues and the Smiths were fairly typical of the black and white families that Oliver and Shapiro studied in the mid-’90s. And what has happened since then is even more disheartening.

Beginning in the ’90s and lasting until the bursting of the real estate bubble, some progress was made. The percentage of black households that owned their own homes increased from 43.3 percent in 1994 to 47.2 percent in 2007. Partly this reflected a still-growing black middle class; partly it reflected important government efforts to end racial discrimination in mortgage lending, along with the arrival of new, responsibly crafted forms of mortgages for which more people, particularly African Americans and Latinos, could qualify.

But around the turn of the twenty-first century, there also grew up a huge new industry of predatory lenders that targeted members of minority groups, including those who already owned their homes and were persuaded to refinance on what turned out to be usurious terms. In 2006, more than half of the loans made to African Americans were subprime, compared to about a quarter for whites. And a recent study of data from the Home Mortgage Disclosure Act found that 32.1 percent of wealthy blacks, but only 10.5 percent of wealthy whites, got higher-priced mortgages—those with an interest rate 3 or more points higher than the rate of a Treasury security of the same length.

The bursting of the real estate bubble has been a catastrophe for the broad American middle class as a whole, but it has been particularly devastating to African Americans. According to the Center for Responsible Lending in Durham, North Carolina, nearly 25 percent of African Americans who bought or refinanced their homes between 2004 and 2008 (and an equivalent share among Latinos) have already lost or will end up losing their homes—compared to 11.9 percent of white families in the same situation. This disparate impact of the housing crash has made the racial gap in wealth even more extreme. As Reid Cramer, director of the Asset Building Program at the New America Foundation, puts it, “Basically, we have gone from an average minority family owning 10 cents to the dollar compared to the average white family to now owning less than a nickel.” The median black family today holds only $4,955 in assets.

In recent years, concerns about racial disparities have largely faded from national politics. It is now a commonplace that we have entered a post-racial era. The concerns of the civil rights era are obsolete. A black family occupies the White House. Conservative jurists and even many liberals are arguing with greater conviction than ever that affirmative action programs and the Voting Rights Act are no longer necessary in a color-blind America. For his part, the first African American president has been remarkably silent on questions of race. University of Pennsylvania political scientist Daniel Gillion examined decades of presidential speeches and found that Barack Obama has said less about race than any Democratic president since 1961.

But for all of the talk about hope and change, the racial wealth gap has not only persisted, it has worsened. And it is this gap that is the most powerful measure of differential well-being by race. Wealth has profound consequences throughout the life cycle, from putting a down payment on a first home to spending your last days in a skilled nursing facility. Starting a business? Paying for college tuition? Making ends meet when you’ve lost your job? Covering extraordinary medical expenses? Retiring? Assets matter.

On each of these counts, minorities face an insecure present and a very precarious future. Consider just one measure: the Brandeis Institute on Assets and Social Policy estimates that only 8 percent of black seniors and only 4 percent of Latino seniors have sufficient economic resources to be economically secure in retirement. “These seniors,” write a team of Brandeis scholars, “do not just have to watch their pennies; they are truly struggling every day, forgoing basic expenditures, such as medical appointments and household maintenance, just to make ends meet.”

A few years ago, I met Roosevelt Smith. He still owned my parents’ old house on Detroit’s West Side, which was a rental property by then, and he gave me a tour. It was in good shape—pretty much the same house that my parents sold, but with newly refinished floors and some new kitchen cabinets and tiles and the garage out back. He’s a resourceful guy who bought a second, larger house nearby—another asset, a nest egg for the future. But together, the two houses aren’t worth much. The median listing price for homes in Detroit is now just $21,000, or about the cost of a Chevy Malibu—and, like the car, likely to depreciate in value from the moment you buy it. Detroit’s population has fallen from 1.85 million in 1950 to a little more than 700,000 today, and as population falls housing demand falls with it. Today, nearly every block has abandoned homes on it. The Smiths probably have more in household assets than the $4,955 median for black families, but not a lot.

In contrast, my parents’ assets have provided them with a cushion of security and more than modest comfort, from that family room they built in the ’70s to the cottage in northern Michigan they built forty years ago and later renovated for their retirement. Along the way, my parents used their savings to help pay for three college tuitions. They helped me buy my first house because I didn’t have enough savings for the 10 percent down payment. When their health deteriorated, they drew from their assets to rent an apartment in a comfortable retirement community. Barring a medical disaster, which my mother could at least partially cover using her remaining assets, my sisters and I can expect a small sum from her estate. Last year, my mother sent me a check—she called it, rather morbidly, a “down payment” on my inheritance—that totaled more than twice the household assets of the median black family.

Sweet Land of Liberty by Thomas J. Sugrue

I have never thought of myself as a particularly wealthy person, and by the standards of the top 1 percent I’m not one. Despite the swings of the economy and a divorce settlement that drained my retirement account, I own a house worth more than twice its original purchase price. I have squirreled away some money in a mutual fund to help pay for my children’s educational expenses: college is just a few years off, and it won’t be cheap. I can also use some of my assets as collateral for loans to help pay their way. And, if my investment decisions prove to be wise, I will have a substantially larger retirement nest egg than my parents had. If I have extraordinary medical expenses, I have funds to fall back on. I also drafted a will, and hope that my heirs—my family and a few charities—will be able to benefit from my good fortune.

There are many white folks who are not as fortunate as my parents were, and even the modest legacy they were able to build may be becoming increasingly rare among younger generations of Americans of all races. Still, like most whites, I am a beneficiary of the racial wealth gap. And until that gap narrows, we can’t begin to talk about the dawning of a post-racial America. [source: The Washington Monthly Magazine ]

No comments:

Post a Comment