Credit was particularly essential in times and places like colonial America where hard currency was scarce. Resourceful merchants and retailers devised clever instruments and institutions of credit that made possible large, complicated transactions even without a fungible means of exchange. Thanks to credit, the absence of cash did not stunt the growth of the young American economy.

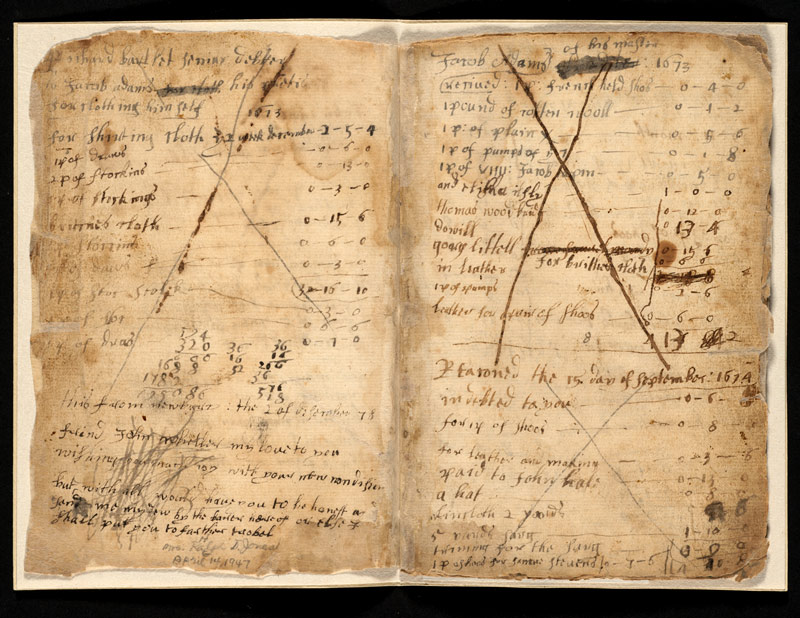

Book credit-so called after the account book in which a storekeeper would record credit or barter purchases-was easily the largest category of pre-industrial credit. The volume of this invisible form of credit may have been a larger part of the pre-industrial money supply than the visible money stock like bank notes or specie. 7

The account books of small-time storekeepers show how common credit purchases were, particularly in agricultural or frontier regions. Farmers, for example, were seldom able to settle their debts more than once a year, at harvest time. Moreover, the difficulty with which most storekeepers finally obtained payment suggests how casually many early Yankees treated their debts. Christopher Clark has found that “rural customers were accustomed to paying for goods as it was convenient, with whatever they had on hand surplus to their needs, and on terms they were prepared to negotiate.”8 Retailers continually struggled with the tradeoffs between extending credit and increasing risk of nonpayment, and tightening credit and seeing business decline.

The ingenuity of American merchants, who raised credit to an art form, ensured that a lack of hard currency did not cripple long-distance trade. Between the 1720s and the 1760s, Thomas Hancock-uncle of Revolutionary War patriot John Hancock-deployed a wide variety of credit transactions to build one of the largest fortunes in colonial America. Because simple barter was so inconvenient, merchants relied instead on “bookkeeping barter,” keeping careful records of a web of debts and credits denominated in shillings and pence, though hard money seldom passed through their hands. To pay up, merchants arranged three-way exchanges of goods and services or waited until they possessed a commodity that a creditor wanted.9 (source: Copyright © 2012 Presidents and Fellows of Harvard College)

The Ascent of Money: A Financial History of The World by Niall Ferguson

No comments:

Post a Comment